If you are an Indian expat living in Kuwait, your primary goal is likely to ensure your hard-earned money reaches your family safely. Managing Kuwait money to Indian money transfers can feel like a full-time job. Rates change every few seconds, and fees can eat into your savings if you are not careful. We understand that every fill counts.

Our team has analysed the current financial landscape for 2026 to help you find the most efficient routes for your remittances. Whether you are sending a small monthly allowance or a large lump sum for an investment, choosing the right provider is vital. This guide breaks down the top options for Kuwait to India and how to maximise your Indian Rupee (INR) returns.

Understanding the Kuwaiti Dinar to Indian Rupee Exchange Rate

The Kuwaiti Dinar (KWD) remains the strongest currency in the world. As of early 2026, the Kuwait exchange rate to INR has seen significant shifts due to global economic changes. While the interbank rate might look attractive on Google, the rate you actually get from an exchange house or bank is different.

We call this the “spread.” It is the difference between the market rate and the rate offered to you. Most providers make their profit here. To get the most Kuwait currency exchange INR value, you must look for providers with the thinnest spreads. Even a difference of 10 paise can mean thousands of Rupees over a year of transfers.

Top Ways for Kuwait to India Money Transfer

When we look at the money transfer options from Kuwait to India, we categorise them by speed, cost, and reliability. Here is how the landscape looks in 2026.

Digital Remittance Apps (Fastest Options)

Mobile applications have revolutionised how we handle money transfers from Kuwait to India. Apps like Al Mulla Exchange, Remitly, and Aspora are currently leading the market. We find that these platforms offer the best balance of speed and competitive rates.

- Al Mulla Exchange: This remains a top choice in Kuwait. Their app is fast, and they often provide special rates for Indian corridors.

- Remitly: Known for its “Express” option, it is ideal when your family needs funds within minutes.

- Aspora: A newer player that has gained traction for its transparent fee structure and high security.

Traditional Exchange Houses

If you prefer a face-to-face transaction, exchange houses like Joyalukkas or Lulu Exchange are still very popular. While they might take slightly longer than a digital app, they offer a sense of security for those sending large amounts. We recommend checking their daily boards as they sometimes run promotions during Indian festivals.

Bank-to-Bank Transfers (SWIFT)

Using your local Kuwaiti bank (like NBK or Gulf Bank) to send money directly to an Indian bank account is the most traditional method. This is often the most expensive way due to the Kuwait to India money transfer fees and intermediary bank charges. However, for massive transfers—like buying property—this is often the most secure route.

Comparing Kuwait to India Money Transfer Fees

Fees are the silent killers of your remittance value. In 2026, many providers claim to have “Zero Fees,” but they usually bake their costs into a lower exchange rate. We suggest looking at the total “Recipient Gets” amount rather than just the fee.

| Provider Type | Average Fee (KWD) | Transfer Speed | Best For |

| Digital Apps | 0.500 – 1.500 | Instant to 24 Hours | Small, frequent transfers |

| Exchange Houses | 1.000 – 2.500 | 1 – 2 Business Days | Mid-sized transfers |

| Local Banks | 3.000 – 5.000 | 3 – 5 Business Days | Large investments |

How to Get the Best Kuwait Exchange Rate to INR

We want you to keep more of your money. Here are our proven strategies to ensure you always win on the exchange rate.

Monitor the Market Trends

Exchange rates are volatile. We suggest using rate alert tools. Many apps allow you to set a target rate. When the Kuwait money to Indian money rate hits your desired number, you get a notification. This is the best way to time your transfers for maximum profit.

Avoid Weekend Transfers

Most currency markets close on weekends. Providers often widen their spreads on Friday nights to protect themselves against market gaps on Monday. We have noticed that mid-week transfers (Tuesday or Wednesday) often yield better results for the Kuwait to India money transfer.

Consolidate Your Transfers

Instead of sending small amounts four times a month, try sending one larger amount. While some apps have flat fees, the cumulative cost of multiple transfers adds up. Additionally, some providers offer better “volume rates” for larger sums.

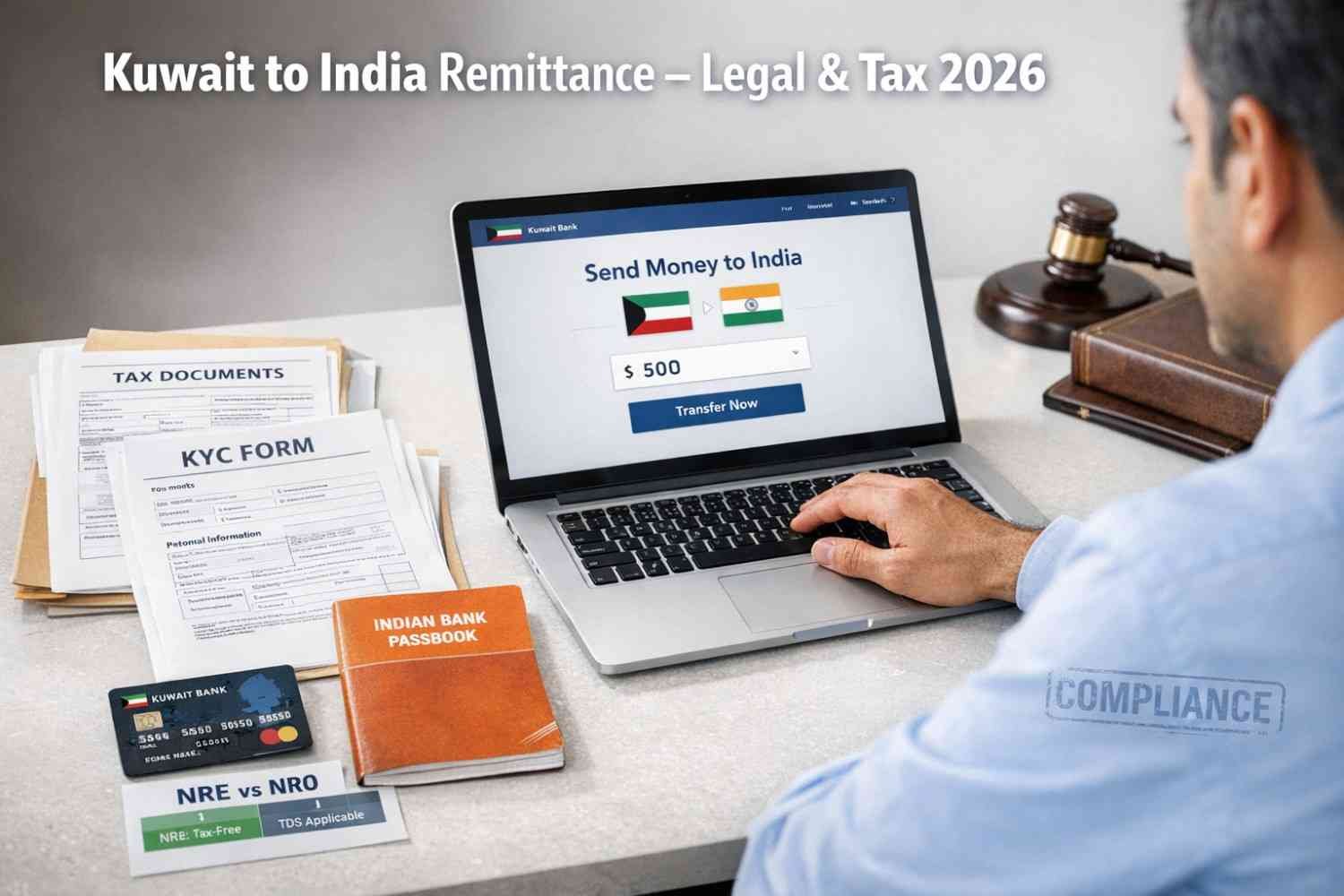

Legal and Tax Considerations for 2026

Sending money home is not just about the rate; it is about staying compliant. Under Indian law, remittances sent to Close Relatives (as defined by the Companies Act) for family maintenance are generally not taxable for the recipient.

However, we recommend maintaining clear records of every Kuwait to India remittance. If you are sending money to an NRE (Non-Resident External) account, the interest earned is tax-free in India. If you use an NRO (Non-Resident Ordinary) account, the interest is subject to TDS (Tax Deducted at Source). Always ensure your KYC (Know Your Customer) documents are updated with your exchange house to avoid frozen transfers.

Essential Checklist for Your Next Transfer

Before you hit the “Send” button, go through our checklist to ensure everything is in order:

- Verify the IFSC Code: Banks occasionally update these. A wrong code can delay your transfer by weeks.

- Check the Name: Ensure the recipient’s name matches their bank records exactly.

- Confirm Total Costs: Ask for the final amount the recipient will receive in INR after all deductions.

- Save the Receipt: Always keep a digital or physical copy of the transaction reference number.

To learn more about managing your home and lifestyle needs while living abroad, check out our guide on modern furniture and console solutions for your home.

Summary

Winning the remittance game requires a mix of timing and the right tools. We recommend using digital apps for your monthly salary transfers to save on the wait for India money transfer fees. For larger life events, traditional exchange houses provide the necessary balance of human interaction and competitive rates. Always prioritise security over a slightly better rate from an unverified source.

Frequently Asked Questions

Which app gives the best rate for Kuwait to India?

In our experience, Al Mulla Exchange and Remitly consistently offer the most competitive rates for the Kuwait exchange rate to INR. However, rates change daily, so we always recommend a quick comparison before sending.

How long does it take for money to reach India from Kuwait?

Digital apps usually complete the transfer within minutes or up to 24 hours. Bank transfers via SWIFT can take 3 to 5 business days.

Are there limits on how much I can send?

Yes, limits depend on your residency status and the provider’s level of KYC. Most apps allow significant daily limits if you provide a copy of your Civil ID and proof of income.

Is it better to send money via a bank or an exchange house?

For most expats, exchange houses and apps are better because they offer higher Kuwait currency exchange INR rates and lower fees compared to commercial banks.

What is the cheapest way to send Kuwait to Indian money?

The cheapest way is typically using a digital remittance app that offers a “New Customer” promotion or a flat-fee structure with a tight exchange rate spread.